Search Results for "vanuatu" in "Vanuatu" on Export Portal

Active Filters

-

Keywords:

-

Country:

- Clear all

New Search

Couldn't find the product you want?

Fill out this form to request the product.

Exports

The economy of Vanuatu is based on agriculture, tourism, offshore financial services, and raising cattle. Exports of Vanuatu include copra, kava, beef, cocoa, and timber, and imports include machinery and equipment, foodstuffs, and fuels. In contrast, mining activity is unsubstantial.

Economic development of Vanuatu is dependent on relatively few commodity exports, vulnerability to natural disasters, and long distances between constituent islands and from main markets.

Agriculture is used for consumption as well as for export. It provides a living for 65% of the population. In particular, production of copra and kava create substantial revenue. Many farmers have been abandoning cultivation of food crops, and use earnings from kava cultivation to buy food. Kava has also been used in ceremonial exchanges between clans and villages. Cocoa is also grown for foreign exchange.

The tropical climate enables growing of a wide range of fruits and vegetables and spices, including banana, garlic, cabbage, peanuts, pineapples, sugarcane, taro, yams, watermelons, leaf spices, carrots, radishes, eggplants, vanilla (both green and cured), pepper, cucumber, and many others.

Vanuatu's economy is primarily agricultural; 80% of the population is engaged in agricultural activities that range from subsistence farming to smallholder farming of coconuts and other cash crops.

Copra is by far the most important cash crop (making up more than 35% of Vanuatu's exports), followed by timber, beef, and cocoa. Kava root extract exports also have become important.

The top exports of Vanuatu are food (like non-fillet frozen fish, rice), cold-rolled iron, refined petroleum and special purpose ships.

The top export partners of Vanuatu are Thailand, Burkina Faso, Japan, Vietnam and Mauritania.

Customs requirements of Vanuatu

Vanuatu Customs Contacts

Website: https://customsinlandrevenue.gov.vu/index.php/en/

Address: Constitution Building, Lini Highway, PMB 9012, Port Vila, VANUATU

Phone: (+678) 24544

Fax: (+678) 22597

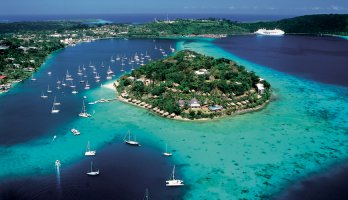

Vanuatu is a island country situated in the South Pacific Ocean. The archipelago's nearest neighbours are northern Australia, New Caledonia, New Guinea, the Solomon Islands and Fiji. Vanuatu is a member of the African, Caribbean, and Pacific Group of States (ACP), World Trade Organization (observer), International Trade Union Confederation (ITUC) and other international organizations.

Tariffs

Vanuatu is in the process of implementing the World Trade Organization (WTO) Customs Valuation Agreement so prospective importers/exporters should check with the Vanuatu Department of Customs, Inland Revenue and VAT for the latest information prior to dispatching goods to Vanuatu.

Most duties are ad valorem, assessed on the Cost, Insurance and Freight (CIF) value (Incoterms 1990) and range from zero to 200%, but in general are about 15-20%. Luxury goods have higher rates. Specific duties are expressed in Vatu per net metric measurement.

Certain goods may be exempt from customs import duties and Value Added Tax (VAT). These include goods for:

- specific end-use

- sale to and exported by tourists

- ships' stores (including fuels)

- processing and re-exportation

- agriculture development projects

- investment projects and goods considered beneficial for the economic development of Vanuatu

- on behalf of or by the Government, international convention or agreement is usually duty and VAT exempt

There is currently a 10% tariff surcharge on all imports, but the Government of Vanuatu has committed to removing this on accession to the WTO.

Non-tariff barriers

Under the Animal Importation and the Plant Protection Acts, listed items posing a negligible risk may be imported without a permit. Imports of other items coming under the Acts require a permit, issued once the safety of the product has been determined.

Packing, marking and labelling

Processed products must be commercially packed and labelled with country of origin indicated.

Special certificates

Certain items require a fumigation certificate e.g. second-hand clothing and copra sacks.

Documentary requirements

Fax signatures are not permitted. It is essential that documents for clearing the goods through customs be dispatched in time. Delays can be minimised by:

- Posting a copy of the invoice directly to the customer, together with the name of ship and intended date of departure (enabling the customer to carry out customs formalities with a bank guarantee in lieu of the bill of lading).

- Cabling or telexing advice of shipment with name of ship, goods dispatched and Free on Board (FOB) (Incoterms 1990) value.

The following documents are required:

Commercial invoice

An original invoice, plus one copy is required and must include:

- a description of the goods

- quantities and dimensions

- net and gross weight

- the country of origin

- the CIF value (Incoterms 1990) or if not available, the value ex-warehouse

- a signature of a responsible member of the exporting firm

Bill of lading

No special requirements. 'To Order' bills acceptable.

Public health requirements

Animal products require import permits from the Ministry of Agriculture, Quarantine, Forestry and Fisheries. Produce, such as fruit and vegetables, needs a phytosanitary certificate and accompanying statement. Exporters should seek the advice of Vanuatu's Quarantine and Inspection Service.

Sources:

https://customsinlandrevenue.gov.vu/index.php/en/travellers/prohibited-imports

https://customsinlandrevenue.gov.vu/index.php/en/corporate/7-cargo-clearance

https://customsinlandrevenue.gov.vu/index.php/en/customs/border-control/customs_charges