Mayo Hegar Needle Holder Tungsten Carbide 14cm

Mayo Hegar Needle Holder Tungsten Carbide 14cm

MASONIC REGALIA GRAND LODGE PAST MASTER APRON PURPLE

MASONIC REGALIA GRAND LODGE PAST MASTER APRON PURPLE

Contemporary Text Cushions for Home decor with screed printed design

Contemporary Text Cushions for Home decor with screed printed design

- 1

- 2

Couldn't find the product you want?

Fill out this form to request the product.

Exports

Pakistan is considered as a developing country and is one of the Next Eleven, the eleven countries that, along with the BRICs, have a high potential to become the world's largest economies in the 21st century.

Primary export commodities of Pakistan include textiles, leather goods, sports goods, chemicals and carpets and rugs.

Pakistan is a net food exporter, except in occasional years when its harvest is adversely affected by droughts. Pakistan exports rice, cotton, fish, fruits (especially oranges and mangoes), and vegetables. The country is Asia's largest camel market, second-largest apricot and ghee market and third-largest cotton, onion and milk market.

Pakistan's industrial sector accounts for about 24% of GDP. Cotton textile production and apparel manufacturing are Pakistan's largest industries, accounting for about 66% of the merchandise exports and almost 40% of the employed labour force. Other major industries include cement, fertiliser, edible oil, sugar, steel, tobacco, chemicals, machinery, and food processing.

The textile industry has the main position in the exports of Pakistan. Pakistan is the 8th largest exporter of textile products in Asia. Pakistan is the 4th largest producer of cotton with the third largest spinning capacity in Asia after China and India, and contributes 5% to the global spinning capacity. China is the second largest buyer of Pakistani textiles, importing US$1.527 billion of textiles last fiscal. China buys cotton yarn and cotton fabric from Pakistan.

Pakistan is one of the largest producers of natural commodities, and its labour market is the 10th largest in the world. Pakistan's main export partners are Afghanistan, China, France, Germany, Italy, South Korea, Turkey, United Arab Emirates, United Kingdom, United States.

Pakistan's main exports are:

- House Linens

- Non-Retail Pure Cotton Yarn

- Rice

- Non-Knit Suits

- Refined Petroleum

- Cotton

- Cement

- Leather Apparel

- Knit Sweaters

Customs requirements of Pakistan

Pakistan Customs Contacts

Federal Board of Revenue of Pakistan

Website: http://www.fbr.gov.pk/

E-Mail: helpline@fbr.gov.pk

Telephone: 051-111-227-227

Fax: 051-9205593

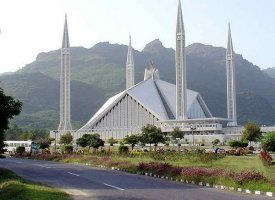

Pakistan is a country situated in South Asia, bordered by Afghanistan, Iran, India and China. It is the sixth most populous country in the world. Pakistan is a federal parliamentary republic consisting of four provinces and four federal territories. It is an ethnically and linguistically diverse country, with a similar variation in its geography and wildlife. Pakistan is a memeber of the Economic Cooperation Organization, Group of 24, International Chamber of Commerce, World Customs Organization, WTO, International Monetary Fund, International Organization for Standardization and other international organizations.

Tariffs

The government of Pakistan is implementing a program of tariff reduction in line with obligations that are part of the World Trade Organization entry. The general tariff rate is expected to drop to around 30 per cent.

Non-tariff barriers

Items banned for import to Pakistan include:

- items that may be repugnant to the injunctions of Islam;

- dyes based on benzidine or containing it;

- hazardous wastes, as defined and classified in the Basle Convention;

- alcoholic beverages and spirits, including brewing and distilling dregs and waste and wine lees and argol;

- factory rejects and goods of job lot, stock lot or substandard quality job lot and stock lot of items where the customs duty is zero%;

- fireworks, fur skins, waste and scrap of polyethylene and polypropylene plastics, retreaded tyres, used pneumatic tyres;

- imports from India have restrictions and only those items can be imported that are specified under the Import Trade and Procedures Order (Appendix B).

Certain restricted items can be imported only if the stipulated conditions are met. Most of the restricted items need prior approval or certification from the relevant government agency. Some of the main items include:

- animal semen

- tobacco products

- radioactive material and apparatus

- seeds

- calcium carbide

- asbestos

- food colours

- dyes

- explosives

- insecticides

Wheat is now importable by the private and public sector. Government has recently imposed a duty of 20% on the import of wheat to discourage wheat import and protect local produce.

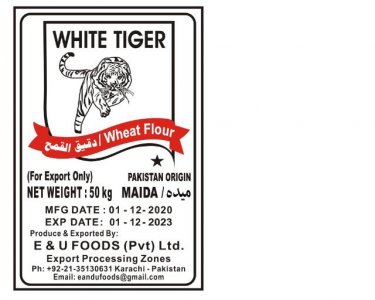

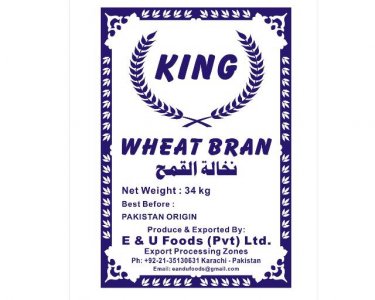

Labelling and marking

Packaging should be conspicuously marked with the country of origin and the name of either the manufacturer or the importer. For textiles this is especially important and the yardage, width and length (if in roll) should also be clearly marked.

Dyes and chemicals must be marked with a full description, including quality and code numbers.

Packets of cigars, cheroots, cigarillos and cigarettes of tobacco or of tobacco substitutes should carry the warning: 'Smoking is injurious to health'.

Food colours must carry fair and true labelling about the product.

Labels on packages for edible products should show that they have at least six months or 50% of the shelf life, whichever is the lesser, calculated from the date of filing of Import General Manifest (IGM) and also that they are free of Haram elements or ingredients. Where these conditions are not printed on the packaging, certificate issued by the manufacturers or principals in respect of these conditions shall be accepted by customs.

Special certificates

Livestock must be accompanied by a sanitary certificate issued by the approved authority in the country of origin.

All plants and plant products, except fruit and vegetables, require a phytosanitary certificate issued by the approved authority in the country of origin.

Hay or straw used as packing material for plants or seeds must be covered by the phytopathological certificate issued by the approved authority in the country or origin.

Leaf tobacco must be covered by additional certification indicating that it is free from ephestiam elutella or that this pest does not exist in the country of origin.

Used clothing should be accompanied by a certificate of cleanliness signed by a physician with the letters MD following the signature.

A special certificate of alcoholic strength may be required for imports of spirituous beverages.

A supplier's certificate or quality and price are required for certain items.

Methods of quoting and payment

Quotes should be cost and freight (C&F) port of delivery in US dollars. Payment must be made by irrevocable letter of credit.

Documentary requirements

Commercial invoice

No prescribed form. Three copies are required.

Invoice must be signed by the manufacturer or shipper and must show:

- names of consignee

- vessel carrying the goods

- number and description of packages

- serial numbers or other identification

- value of goods C&F (freight charges to be shown separately)

- country of origin.

Except where it is not possible to do so (bulk items or where products are marketed under generic names) the invoice shall give the brand name of the product being imported.

A signed declaration of origin is required.

Bill of lading/airway bill

To Order bills are acceptable and must show:

- gross weights and dimensions in metric units

- name and address of the party to be notified.

Packing list

Not obligatory, but facilitates clearance.

Certificate of origin

Although not legally required, the importer or their bank frequently requests this document. If not provided, a statement of origin should appear on the invoice.

Public health requirements

The import of livestock, plants and plant material is subject to specific regulations.

New pharmaceutical preparations not previously imported require the prior approval of the Pakistani Director-General of Health. For this approval, the Director-General requires, free of cost, a supply of the preparation to treat about 60 patients. Pharmaceutical industries holding valid licenses are permitted to import pharmaceutical raw material subject to the condition that pharmaceutical (allopathic) raw materials are of pharmaceutical grade and have at least 75 per cent of the shelf life calculated from the date of filing of IGM. Pharmaceutical raw materials specifically allowed by the Director-General are exempt from the above requirements. Import of pharmaceutical products is subject to the conditions and limitations laid down in the Drugs Act 1976.

Calcium carbide, whether or not chemically defined, requires prior approval of the Department of Explosives. Used or refurbished cylinders (for compressed or liquefied gas) for use in motor vehicles need a safety certificate from the Department of Explosives.

Arms and ammunition not otherwise banned would require authorisation from the Ministry of Commerce.

Ingredients for formulation or manufacturing of pesticides are importable only by industrial users.

Insurance

The importer must arrange insurance through an insurance company registered in Pakistan.

Sources:

http://www.wipo.int/wipolex/en/text.jsp?file_id=189220

http://www.pakistancustoms.net/2014/01/documents-required-for-import-in-pakistan.html

http://www.tdcp.gop.pk/tdcp/TravelGuide/CustomsRegulations/tabid/164/Default.aspx