Couldn't find the product you want?

Fill out this form to request the product.

Imports

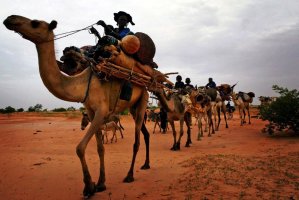

Mali, officially the Republic of Mali, is a landlocked country in West Africa. Mali is the eighth largest country in Africa, with an area of just over 1,240,000 square kilometres. The population of Mali is 14.5 million with the capital of Bamako. The landlocked West African country of Mali - one of the poorest in the world - experienced rapid economic growth after the 1990s, coupled with a flourishing democracy and relative social stability.

Mali consists of eight regions and its borders on the north reach deep into the middle of the Sahara Desert, while the country's southern part, where the majority of inhabitants live, features the Niger and Senegal rivers. The country's economic structure centers on agriculture and fishing. Some of Mali's prominent natural resources include gold, being the third largest producer of gold in the African continent, and salt, but the other commodities and necessities have to be exported to Mali from outside. For example, machinery and equipment, construction materials, petroleum, foodstuffs, and textiles are imported.

Mali main import is fuel (42 percent of total imports) followed by capital equipment and foodstuffs. Mali main import partner is China (20 percent of total imports). Others include: Senegal, China, France and Ivory Coast.

According to the International Trade Centre, the top five import categories for Mali are:

- Mineral fuels, oils, distillations products, etc. (representing 21.4% of total imports)

- Boilers, machinery, nuclear reactors, etc. (representing 11.8% of total imports)

- Vehicles other than railway (representing 6.7% of total imports)

- Electrical and electronic equipment (representing 6.6% of total imports)

- Salt, sulphur, earth, stone, plaster, lime, and cement (representing 6% of total imports)

Customs requirements of Mali

Malian Customs Contacts

Website: http://primature.gov.ml/primature/

Email: cigma@primature.gouv.ml

Telephone: +22320230013

Fax: +32 3 233 61 12

Address: Bolloré Africa Logistics, Rue Baba Diarra, P.O. Box 2454, Bamako, Mali

Republic of Mali a landlocked country in Western Africa consisting of eight regions.

Mali is a member of WTO and the Organization for the Harmonization of Business Law in Africa (OHADA). Mali is a part of "French Zone" (Zone Franc), which means that it uses CFA franc. Mali is connected with the French government by agreement since 1962 (creation of BCEAO). Today all seven countries of BCEAO (including Mali) are connected to French Central Bank.

Mali Import regulations:

Wild Fauna and Flora: Plants and parts thereof: phytosanitary certificate must be issued by the authorities in the country of origin, except fresh fruit and vegetables for consumption.

Prohibited import

- Alcohol and other spirits are prohibited and should be sent separately

- Weapons (Certificate required)

- Drugs

- Books, films and pictures (subject to censorship and confiscation if contrary to local customs)

Restricted import

- Home computers are not accepted as personal effects and are subject to duties and import taxes.

- New electrical items are subject to payment of Customs duties and taxes.

- Invoices of all electrical items and furniture must be more than six months old.

- Vehicle – New cars are dutiable, and import license is required for new cars.

- Pets – a Health Certificate from veterinarian required

- Firearms and ammunition (authorization from the territorial administration is required)

- New computers (tax is 65%) - excludes Diplomats, embassies and persons with authorization

- from the Malian Customs head office.

- New electrical items

- Prescription medications (health certificate required)

- Importation of meat other than bovine and game products : presentation of the certificate of origin and the sanitary certificate

- Importation of fishing nets in fine meshing (smaller than 50 mm) : authorization from the Ministry of Water and Forest

- All medicines for human use: authorization from the Ministry of Public Health

- All medicines for veterinary use: authorization from both Ministry of health and Ministry in charge of stock breeding

- Dichlorodiphenyltrichlorethane (“DDT”): authorization from the ministry of Environment

- Weapons and ammunitions: authorization from the concerned authorities

- Importation of non-ionized salt, not destined to human consumption: authorization from the concerned authorities

- Importation of explosives and pyrotechnic products: authorization from the concerned authorities

- Importations of cyanide: authorization from the Ministry of health or the Ministry of Mines

- Products that deplete the stratospheric ozone layer (substances containing chlorine or bromine, CFC and HCFC): authorization from the Ministry in charge of the Environment

Import Of Motor Vehicles

Documents Required:

- Original Registration Card

- Original Bill of Lading (OBL) / Air Waybill (AWB)

- Non-sale Certificate

- Purchase Invoice / Certificate of Value

The duty rates on motor vehicles is as follows:

- If the motor vehicle is new, tax is 44% of the Argus value + EUR 40.00 / year

- If the motor is 10 years or older, tax is 44% of the Argus value + 10 x 40 = EUR 400.00)

Listing Of Goods Exempted from PSI

a) Goods with a total FOB value under XOF 3,000,000 (but goods amounting to XOF 100,000 or more are subject to an II application),

b) Precious metals, precious stones, objects of art,

c) Explosives and pyrotechnic products,

d) Ammunitions and weapons other than those for hunting and/or sport, materials and equipments ordered by thearmy for its own account,

e) Live animals,

f) Wood,

g) Scrap metal,

h) Plants, seeds and flowering products,

i) Fertilizers,

j) Cinematographic films –exposed and developed,

k) Current newspapers and periodicals, postal stamps and fiscal stamps, stamped papers, bank notes, cheque

books, credit cards,

l) Crude oil,

m) Sera, vaccines,

n) Personal effects and domestic used items, including one used vehicle,

o) Postal parcels and commercial samples,

p) Personal gifts, donations (except donations to private persons or private entities), bona fide gifts, supplies to

diplomatic and consular missions and supplies to United Nations Organisations for their own use in Mali,

q) Imports ordered by the public administrations for their own account,

r) Vehicles of heading 8701 to 8705 and 8716.

Importers Fiscal Identity Numbers [NIF]

In accordance with the latest decision of the Mailan customs authorities, the importers fiscal identity number [NIF = numero d'identification fiscale] must be mentioned on all import documents, for border crossing operations.

This number is the identification number of the Importer/Consignee at the Malian Tax Ministry. In this respect please make sure and mention this ID number on all shipping documents [at least suppliers' invoice, if possible the B/L]. Since this document is required for forwarding purpose out of port of discharge to Mali, we need to receive it prior to vessel arrival with the advance notification or the shipping document, otherwise the on carriage will be delayed until this number is known.

Currency Export regulations:

Local currency (CFA Franc-XOF): unlimited; foreign currencies: equivalent of XOF 25,000.- in banknotes. NON-RESIDENTS who made a declaration on entry may re-export all their currencies less a reasonable amount equivalent to their expenses in Mali. No restrictions on foreign currencies in the form of cheques or letters of credit.

Sources:

http://www.tradingeconomics.com/mali/imports

https://mali.visahq.com/customs/

http://www.iatatravelcentre.com/ML-Mali-customs-currency-airport-tax-regulations-details.htm

https://www.iamovers.org/files/newimages/member/shippers/mali.pdf

http://www.iatatravelcentre.com/ML-Mali-customs-currency-airport-tax-regulations-summary.htm

http://www.delmas.com/static/eCommerce/Attachments/Mali030914b.pdf